A Free Republic Depends on Worker Power

A powerful workforce counters domination within the firm and within society.

by Joshua Preiss

This article first appeared on The American Conservative, April 20, 2023

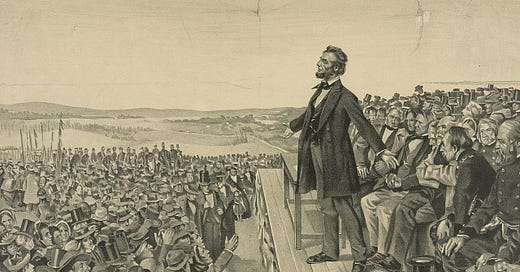

“Capital is only the fruit of labor, and could never have existed if labor had not first existed. Labor is the superior of capital, and deserves much the higher consideration.”

This passage from Abraham Lincoln’s first annual message highlights a key feature of Republican Party philosophy at its founding. Citizen workers are the foundation of a free society. A central goal of government policy, then, is to further the welfare, status, and opportunity of ordinary workers. The abolition of slavery is the most pro-worker policy in the history of the United States. In Lincoln’s view, abolition was fundamental to republican efforts to redeem the moral core of the Union, as reflected in the Declaration of Independence. Republicans failed to extend property ownership, and with it greater economic independence, to recently freed slaves. This failure shaped much of the racial politics that followed. However, Lincoln could boast about many great policy successes. The Homestead Act, passed after Southern secession in 1862, ensured a more egalitarian distribution of productive land.

That same year, the Pacific Railroad Act began the transformation and modernization of America’s productive infrastructure. The Morill Act enabled a similar transformation in America’s human capital by making public higher education far more accessible, diffusing the gains from technological innovation, and raising the standards of primary and secondary education along with it. Taken together, these acts empowered property-less American citizens, including recent immigrants, providing them with significant opportunities and greater freedom from domination in the workshop (as was Thomas Jefferson’s vision). In the process (following Alexander Hamilton’s vision) they laid the foundation for America to become a global manufacturing powerhouse.

In his first State of the Union Address, Theodore Roosevelt highlighted another foundational tenet of the Republican Party: private, unaccountable concentrations of economic power are a threat to a free republic. “There is a widespread conviction in the minds of the American people,” Roosevelt argued, “that the great corporations known as trusts are in certain of their features and tendencies hurtful to the general welfare.… It is based upon sincere conviction that combination and concentration should be, not prohibited, but supervised and within reasonable limits controlled; and in my judgment this conviction is right.” The previous half century of development, in the mind of Roosevelt and many of his fellow Americans, revealed how market power can undermine republican ends. Economic power translates into political power. In the process, it undermines political accountability, a key component of freedom in republican political philosophy and the freedom-based justification for the American revolution.

Powerful firms, then, create barriers to entry in the market (or buy up potential competition) further concentrating their market power and slowing innovation and economic growth. This market power allows the owners of large firms to capture a larger share of the fruits of growth, while subjecting more vulnerable workers to domination in the workplace. To counter this threat, Roosevelt’s administration resurrected the Sherman Act to break up Rockefeller’s Standard Oil Company and J. P. Morgan’s Northern Securities Company, both of which had built empires on the back of government infrastructure investment. The Hepburn Act further expanded the reach of the Interstate Commerce Commission to combat abuses of market power in railway commerce. In the Coal Strike of 1902, Roosevelt refused to send in the National Guard to violently break up striking coal miners. Instead, he endeavored to put workers on a more equal footing with their employers. Providing a square deal, a term coined by Roosevelt to describe the settlement of the coal strike, became the central theme of his domestic economic policy.

With this republican moral and historical lens in place, let us look at recent, innovative work on the economics of market power. Jan Eeckhout, Jan de Loecker, Gabriel Unger, and others highlight the role that market power plays in the rise of markups—the ability of firms to charge more than the marginal cost for goods and services—in the past four decades. In 2016, firms were able to charge 61 percent over cost, compared to just 21 percent in 1980. At the same time, the average profit rate has increased from 1 percent to 8 percent. This steady rise is not spread evenly throughout the market. Instead, it is driven by a relatively small number of historically profitable firms with significant market (pricing) power. This pricing power pushed corporate profits to near record highs even as inflation cut into the purchasing power of most workers.

Perhaps paradoxically, the immense profitability of these firms functions to suppress aggregate demand and productivity. As high-profit, high-markup firms claim a larger and larger share of sales, the economy produces less than it would if it were more competitive. An increase in markups, as a result, implies diminished demand for labor. Workers may miss this connection because firms with significant market power are able to—and often do—employ more workers and pay higher wages than competitors. It’s just a small share of their enormous profits. The result is further concentration of market and employment share among firms with the highest markups, precisely the opposite of what we would expect from models of perfect competition. In addition, the use of workplace data and surveillance technology lowers efficiency wages by making it less necessary for firms to motivate employees with a larger share of the fruits of their great market power.

Just as market power enables markups in the price of goods and services, it leads to markdowns in the wages of workers. In the past two decades many economists have shown renewed interest in the imbalance of power between employers and workers in the labor market. Monopsony (labor market or “buy side” market power), a concept introduced by the great labor economist Joan Robinson, occurs anytime the labor supply curve to individual employers is inelastic, such that cuts in wages do not lead to the loss in workers predicted by textbook economic models. The archetypal case of monopsony is the company town of yesteryear. Recent scholarship, however, points to a number of sources of monopsony power in the labor market, including not only market concentration but also non-compete clauses, network effects, low information, job search difficulties, and lack of labor mobility in a geographically polarized economy.

The predictable impact of market power, again, is lower wages and productivity. Consider a simplified model, adapted from recent work by Suresh Naidu, of a firm considering potential workers (Jessica and Nicole) who would generate $25 an hour for the firm. Jessica would only accept an offer at $23, while an equally productive worker, due to several sources of monopsony described above, Nicole would accept $16. The firm, however, can’t know which worker would accept which rate, and it would otherwise be infeasible for them to tailor wages and benefits to each individual employee. Therefore, they face a choice: (1) employ both workers at $23, producing $50 of goods and services an hour with $4 profit, or employ Jessica at $16, producing $25 with $9 profit. Firms focused on profit-maximization will pick the latter. In this way, market power provides a clear incentive for firms to employ fewer workers, pay them below their marginal productivity, and leave productive capital on the sidelines.

Unfortunately, for decades, the Republican Party has largely failed to follow the example of their predecessors. Many Republicans appear to have embraced an economic orthodoxy that refused to see market power as a meaningful threat to freedom, welfare, and efficiency. The Lincolnian ideal of a labor-centered economy was gradually replaced by one focused on protecting and expanding the rights and power of capital. One source of this change may be that party members clung to the idea of a republic of independent farmers and small-business owners, even as economies of scale increasingly made that idea impracticable. Contrary to the republican ideal, control over productive capital is highly concentrated.

A free and just society, as a result, depends on policy that empowers workers. Republicans (and Democrats) can follow Lincoln's and Roosevelt’s examples. First, use antitrust legislation not only to protect consumers from high prices but also to protect workers and citizens from the deleterious impact of market power. A central consideration when evaluating mergers, for example, should be their impact on the labor market. Just as in Roosevelt’s time, there is clear, bipartisan concern for concentrations of corporate power. Absent government action, this concentration will likely get worse as artificial intelligence transforms economy and society. A small handful of companies control much of the resources and knowledge in AI, with research priorities dedicated to growing their market power and cutting labor costs rather than serving the public good.

Perhaps even more importantly, Americans should use public policy to ensure that workers receive a much larger share of the rents that flow from any market concentration. One time-tested way to do so, as many conservatives have recently argued, is to provide effective policy infrastructure for organized labor. In particular, Americans could push for legislation to move past the firm-based, adversarial approach to collective bargaining, which encourages a race to the bottom in worker wages and power, to sectoral bargaining that forces firms to compete on a level playing field.

Another way to further worker power is to provide them with better employment opportunities and the resources to search for those opportunities. Interestingly, the post-Covid economy provides some insight into how this could work. The pandemic functioned to counter monopsony power by compelling workers to switch jobs, but to do so without severe economic insecurity because public policy provided them some cushion during their search. As a result, ordinary workers moved up the wage and firm productivity ladder. Lower-income workers, in particular, were able to claim a larger share of the fruits of economic growth, partially reversing a decades-long trend of rapidly increasing wealth for those at the top and stagnating wages for the bottom half of the working population.

To make this rising labor share a trend, and to counter the inflationary effects of supply chain disruptions in an era of great geopolitical uncertainty, Americans need industrial policy that incentivizes robust private investment in domestic manufacturing. One quirk of the Inflation Reduction Act is that, despite the fact that no Republican senators or representatives voted for it, it promises to be a boon to manufacturing in “red” counties and states, including areas hardest hit by globalization. One large multinational corporation after another is announcing plans to build a factory in the U.S. in response to the bill. A central goal of industrial policy must be to ensure demand for labor even as wages rise, rather than to treat rising wages as a problem to be solved.

Geographically broadening prosperity is essential to countering monopsony power. Commodified labor is far less mobile than capital or non-labor commodities, in part because it consists of actual humans. Not only do they care about their price, but they have families, social commitments, and community ties and traditions. Workers hard hit by globalization are understandably loathe to leave what sources of family and community support they have, and possess few resources with which to do so even if they wanted to. Indeed, exponential growth in the price of rent and real estate in productivity hubs, with significant decline in home values in areas left behind, makes it difficult for even solidly middle-class families to do so. All of these factors provide clear disincentives to move in search of better work, even if by some models “community-less” or “nation-less” agents would be more “efficient.”

An important source of geographical development inequalities is the predictable decline in new business creation in economically distressed areas. Young firms are responsible for most job growth. To start these firms, individual entrepreneurs often rely upon the equity of their homes as collateral. In distressed areas, their homes are worth far less, while local banks face all sorts of predictable challenges due to regional economic decline. For these reasons, there is significant potential for place-based development initiatives—including targeted tax credits focused on high-multiplier industries, public-private partnerships, infrastructure development, and investment in public services—to close massive regional gaps in prosperity.

Federal Reserve efforts to combat inflation, combined with the existing structure of the Federal Deposit Insurance Corporation (FDIC), which only insures deposits up to $250,000, threaten to exacerbate financial domination. All banks face pressure from the rising spread between the return on investments in loans and long-dated bonds and the rapidly rising cost of retaining deposits when treasuries and money market funds offer 4–5 percent. Larger banks, deemed of systemic importance, operate with implicit government subsidy. Even in times of relative stability, this subsidy boosts share price and lowers borrowing for large banks, increasing their profits and market share. At present, it is leading to a flight of deposits from local and regional banks. Given the role these banks play in productive investment, this flight is particularly troubling for the American worker. In response, we should immediately expand “risk-priced” FDIC insurance to all deposits, while exploring other regulatory reforms to lower the risk of bank runs and the ability of “systemically important” banks to collect massive rents on the productivity of the rest of the economy.

Conservatives have long emphasized a key strand of America’s republican tradition: the importance of adopting public policy that encourages individual and civic virtue. Despite their disagreements, what republicans from Thomas Jefferson and Hamilton to Lincoln and Frederick Douglass recognized, and what many current members of the Republican Party appear to miss, is the link between economic power and opportunity and that virtue. It makes no sense, for example, to implore workers to be more industrious and take greater personal responsibility while adopting policies that lead to declining or stagnating wages and diminish worker power and security in the marketplace. One crucial source of virtue is the hope that through hard work they can achieve a better life for themselves and their communities. If Americans want more virtuous workers and citizens, we need to restore that hope through more worker-friendly policies.

In addition to using existing anti-trust provisions to combat monopsony power, changing labor law to facilitate sectoral bargaining, targeted place-based development policies, and banking and financial market reforms, Americans should pass bipartisan legislation for coordinated industrial policy, and build on it through policy and public investment to put us on a path of innovation more conducive to a healthy democracy with a thriving middle-class. A powerful workforce counters domination within the firm and within society. In addition, it pushes firms to compete through innovation and productivity rather than through profiting from low wages. The result is an economy that puts more productive resources to use, where demand increases because workers receive a larger share of the fruits of economic growth, and the citizen worker takes their pride of place at the center of American society. More than perhaps any other time in our nation’s history, empowering workers is essential to achieving the republican vision of a free and just American society.

This article is part of the American System series edited by David A. Cowan and supported by the Common Good Economics Grant Program. The contents of this publication are solely the responsibility of the authors.

Joshua Preiss is Professor of Philosophy, Director of the Program in Philosophy, Politics, and Economics at Minnesota State University, Mankato, and the author of Just Work for All: The American Dream in the 21st Century.

I am very curious as to whether the authors are familiar with another blog on the American System, americansystemnow.com, which was begun in 2017 by Nancy Spannaus, author of Hamilton Versus Wall Street?